bear trap stock example

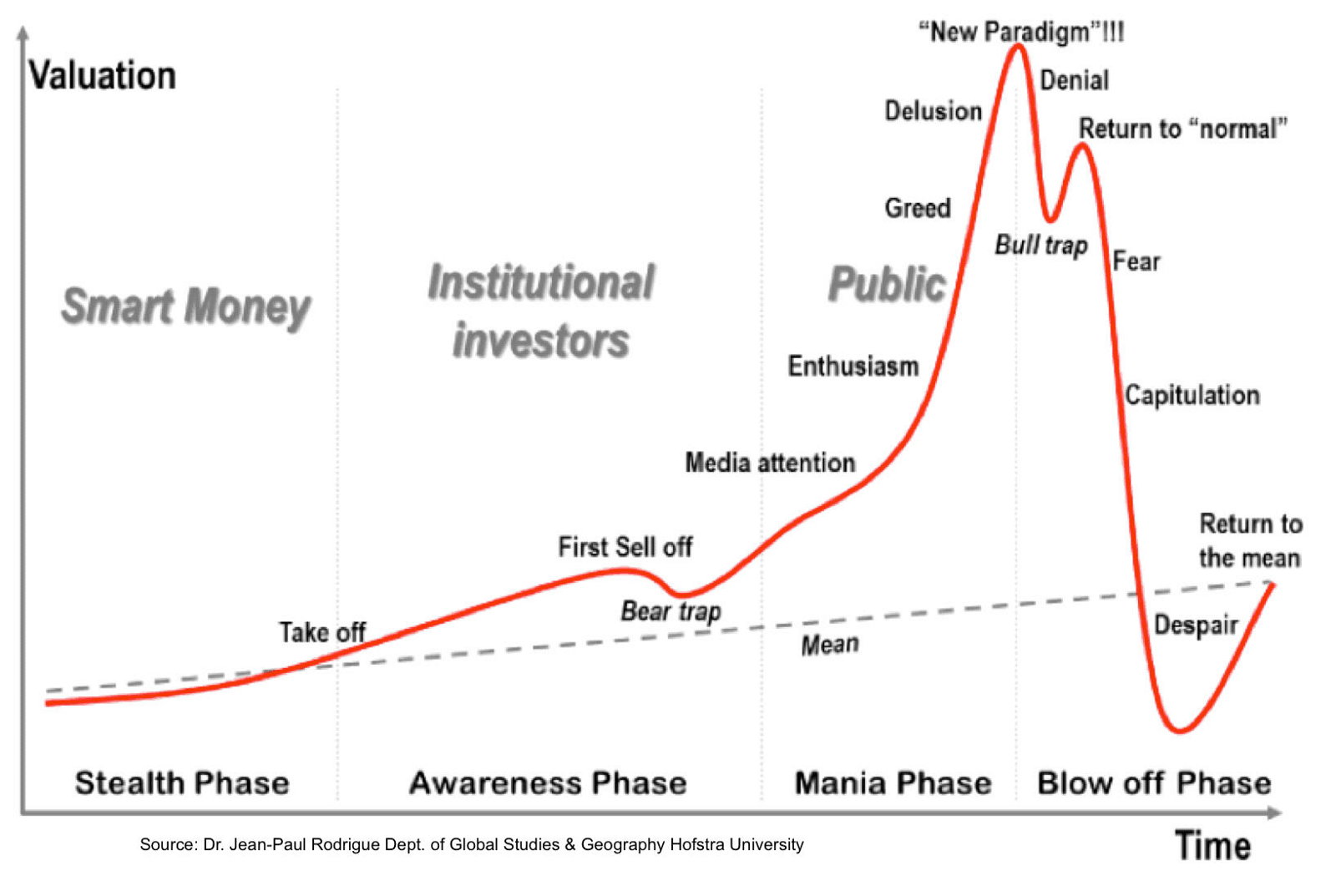

Bounce which will often precede the short-term top in the. Bear trap example Suppose youve.

Bear Trap Best Strategies To Profit From Short Squeezes Tradingsim

Bear Trap Chart Example.

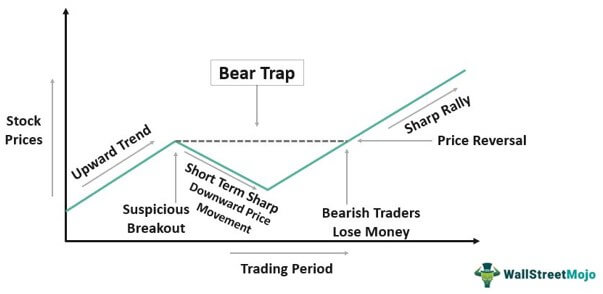

. A bear trap is common when trading various assets such as stocks currencies and commodities. Now is the time to move. Although the definition is simple its always better to look at real-market examples.

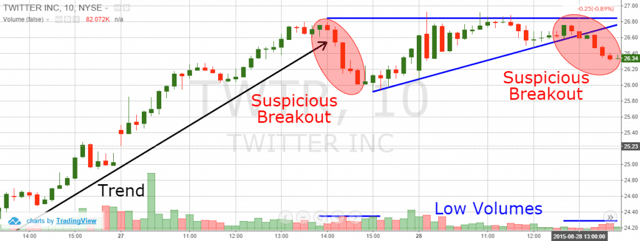

Also referred to as a suckers rally bull trap or dead cat bounce bear market rallies can trick investors into buying. The bull trap is always created around an important market area or level. A bear trap stock is a downward share price that lures investors to sell short but then sharply reverses with the price moving positively.

In general a bear trap is a technical. A bear trap is a trading term used to describe market situations that indicate a downturn in prices but actually leads to higher prices. Bear Trap Chart Example.

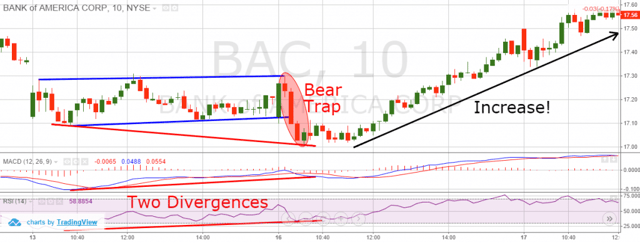

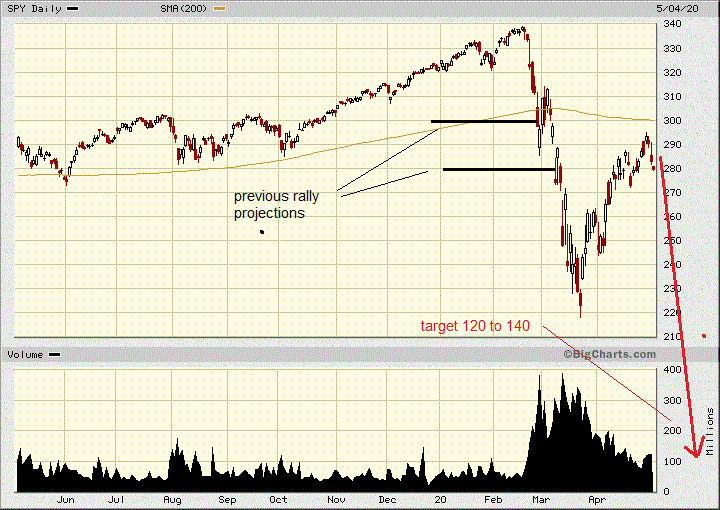

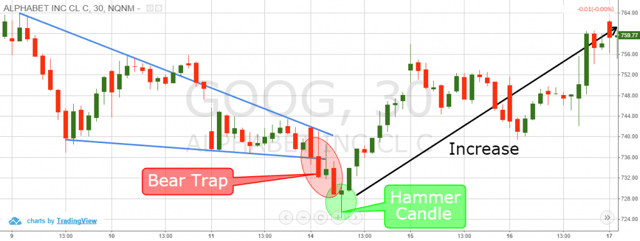

Its a technical pattern where the price dips or starts falling then quickly. Discover the Power of thinkorswim Today. For instance in this daily chart of the.

A bull trap is a false signal indicating that a declining trend in a stock or index has reversed and is heading upwards when in fact the security will continue to decline. Below we will consider the popular. A bear market rally is when prices rise during a bear market.

To avoid the negative effects of a bear trap dont take a short position on a stock or sell your holdings just because the price has dropped. Our Suite of Platforms isnt Just Made For the Trading Obsessed - its Made by Them. Investors and traders take short positions.

Bear-market bounces arent rare for US. These 5 companies are set for historic price action. Stocks when looking at nearly 50 years of history.

Bear Trap Trading Examples. A bear trap is a false selling signal that occurs when an equity that has been in a bullish pattern quickly breaks to the downside. Rising stock prices cause losses for bearish investors who are now trapped.

Ad See how Invesco QQQ ETF can fit into your portfolio. An example of a bear trap. Ad When you sign up youll reveal the names and ticker symbols of these 5 companies.

If XYZ rose to 50 you would owe. Bear traps occur when investors bet on a stocks price to fall but it rises instead. Bear Trap Example.

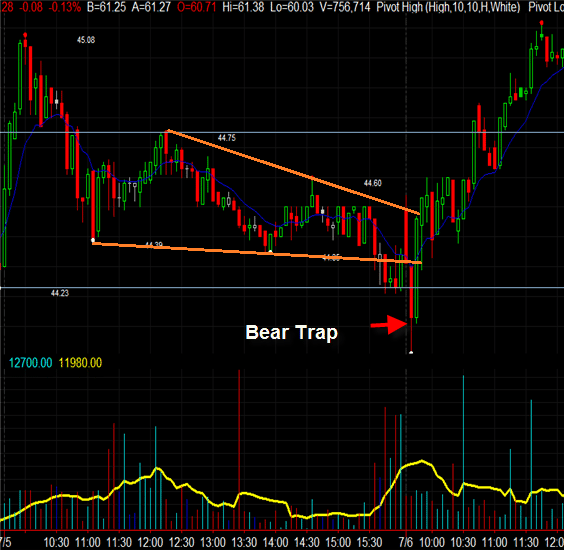

Below is an example of a bear trap on 76 for the stock Agrium Inc. Bear Trap Chart Example. Access the Nasdaqs Largest 100 non-financial companies in a Single Investment.

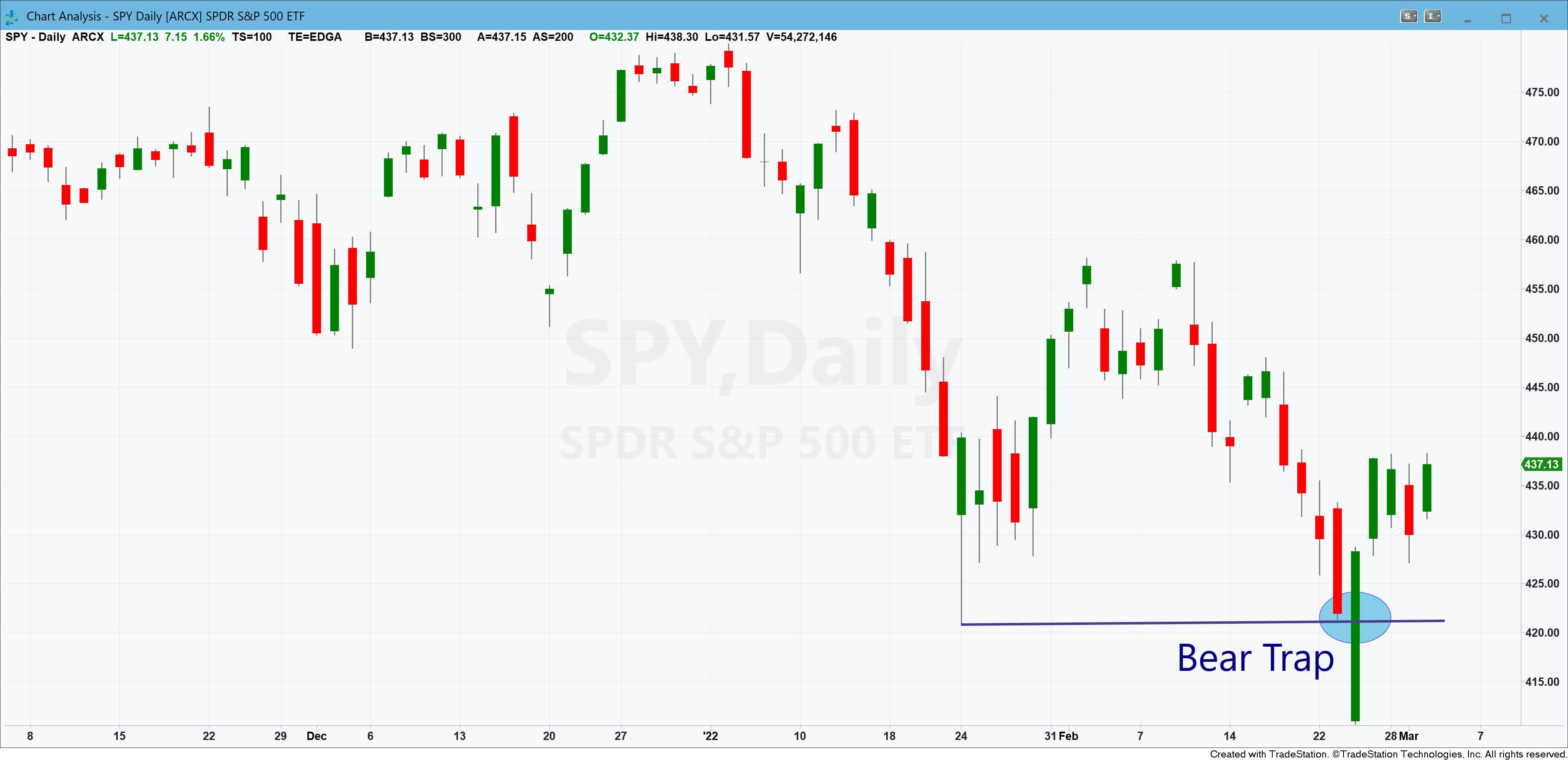

For example if you short sold 50 shares of XYZ and they are now trading at 40 you owe your broker 2000 50 x 40. When a bear trap occurs usually there is a false breakdown of the support level the purpose of which is to drive as many traders as possible into a trap. How to Identify a Bull Trap.

This can be an area such as a major moving average but it is often a major resistance. Below is an example of a bear trap on 76 for the stock. You will notice that the stock broke to fresh two-day lows before having a.

Bear Trap Explained For Beginners Warrior Trading

3 Bear Trap Chart Patterns You Don T Know

What Is A Bear Trap On The Stock Market Fx Leaders

The Great Bear Trap Bull Trap Seeking Alpha

Bear Trap Best Strategies To Profit From Short Squeezes Tradingsim

Bear Trap Best Strategies To Profit From Short Squeezes Tradingsim

What Is A Bear Trap On The Stock Market Fx Leaders

Bear Trap Explained For Beginners Warrior Trading

What Is A Bear Trap On The Stock Market Fx Leaders

Bear Trap Stock Trading Definition Example How It Works

Bear Trap Explained For Beginners Warrior Trading

What Is A Bear Trap In Trading Litefinance

Bear Trap Explained For Beginners Warrior Trading

Bull Trap Vs Bear Trap How To Identify Them Phemex Academy

The Great Bear Trap Bull Trap Seeking Alpha

3 Bear Trap Chart Patterns You Don T Know

What Is A Bear Trap Seeking Alpha

Bear Trap Best Strategies To Profit From Short Squeezes Tradingsim

Bear Trap Best Strategies To Profit From Short Squeezes Tradingsim